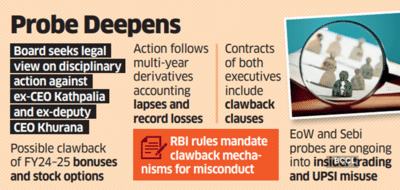

MUMBAI: The board of IndusInd Bank has sought legal opinion on initiating disciplinary proceedings against former CEO Sumant Kathpalia and former deputy CEO Arun Khurana, people familiar with the matter told ET. Likely penalties include clawing back of earlier bonuses and stock options paid to them over FY24 and FY25.

Both executives exited the bank after the lender acknowledged accounting anomalies over multiple years, leading to record quarterly losses and stock value erosion earlier this year.

"The board of IndusInd Bank has sought legal opinion on fixing management responsibility for the losses arising from the derivatives portfolio," said an official in the know. "This includes the clawback of bonuses and stock options granted to Sumant Kathpalia and Arun Khurana over the past two financial years. The bank has also initiated disciplinary proceedings in line with its internal code of conduct and governance policies."

The Reserve Bank of India's ( RBI) November 2019 guidelines on the compensation of key managerial personnel direct banks to establish a clawback mechanism for variable pay to address misconduct risk and ensure compliance with all relevant statutory and regulatory requirements.

The clawback clauses feature in the employment contracts of the executives concerned, allowing the bank to launch recovery of compensation in cases of proven misconduct or violations of company policy, said the people cited above.

IndusInd Bank did not respond to ET's queries. Kathpalia did not respond to messages. Arun Khurana said he has no information regarding the matter.

'Heads Will Roll'

On October 18, Rajiv Anand, the current MD & CEO of IndusInd Bank, said that as part of efforts to fix accountability in its treasury operations that disclosed the accounting lapses, employees would be asked to leave if found involved in window-dressing the accounts.

While the financial impact of the anomalies stemming from erroneous derivatives accounting has largely been addressed, investigations by law enforcement agencies are still underway.

"We continue to work closely with the law enforcement agencies to take it to its logical conclusion," Anand had said on October 18 after the earnings announcement.

Kathpalia received a variable pay of Rs 6 crore for the financial year 2022-23. The variable pay consisted of 30% cash and 70% non-cash (share-linked instruments). Of the cash component, 50% was paid upfront, while the remaining 50% was deferred with a three-year vesting period.

The entire non-cash component also carried a three-year vesting period. It could not be ascertained whether the bank obtained RBI approval for variable pay in the subsequent years. Kathpalia earned a fixed salary of Rs 7.50 crore in FY24 while Khurana earned Rs 5 crore.

In FY 2024-25, Sumant Kathpalia exercised 2,48,000 stock options, while Arun Khurana exercised 5,000 stock options, according to the bank's disclosures.

The EoW of the Mumbai Police is already investigating several current and former senior executives of the bank, including former CEO Kathpalia and former deputy CEO Khurana, in connection with losses worth Rs 2,000 crore linked to mis-accounted internal derivative trades.

The Securities and Exchange Board of India (Sebi) is also investigating allegations of insider trading and misuse of unpublished price-sensitive information (UPSI) against Kathpalia and Khurana. According to a May 28 ex-parte interim order, both individuals were barred from trading in the securities market and asked to disgorge alleged illegal gains.

Both executives exited the bank after the lender acknowledged accounting anomalies over multiple years, leading to record quarterly losses and stock value erosion earlier this year.

"The board of IndusInd Bank has sought legal opinion on fixing management responsibility for the losses arising from the derivatives portfolio," said an official in the know. "This includes the clawback of bonuses and stock options granted to Sumant Kathpalia and Arun Khurana over the past two financial years. The bank has also initiated disciplinary proceedings in line with its internal code of conduct and governance policies."

The Reserve Bank of India's ( RBI) November 2019 guidelines on the compensation of key managerial personnel direct banks to establish a clawback mechanism for variable pay to address misconduct risk and ensure compliance with all relevant statutory and regulatory requirements.

The clawback clauses feature in the employment contracts of the executives concerned, allowing the bank to launch recovery of compensation in cases of proven misconduct or violations of company policy, said the people cited above.

IndusInd Bank did not respond to ET's queries. Kathpalia did not respond to messages. Arun Khurana said he has no information regarding the matter.

'Heads Will Roll'

On October 18, Rajiv Anand, the current MD & CEO of IndusInd Bank, said that as part of efforts to fix accountability in its treasury operations that disclosed the accounting lapses, employees would be asked to leave if found involved in window-dressing the accounts.

While the financial impact of the anomalies stemming from erroneous derivatives accounting has largely been addressed, investigations by law enforcement agencies are still underway.

"We continue to work closely with the law enforcement agencies to take it to its logical conclusion," Anand had said on October 18 after the earnings announcement.

Kathpalia received a variable pay of Rs 6 crore for the financial year 2022-23. The variable pay consisted of 30% cash and 70% non-cash (share-linked instruments). Of the cash component, 50% was paid upfront, while the remaining 50% was deferred with a three-year vesting period.

The entire non-cash component also carried a three-year vesting period. It could not be ascertained whether the bank obtained RBI approval for variable pay in the subsequent years. Kathpalia earned a fixed salary of Rs 7.50 crore in FY24 while Khurana earned Rs 5 crore.

In FY 2024-25, Sumant Kathpalia exercised 2,48,000 stock options, while Arun Khurana exercised 5,000 stock options, according to the bank's disclosures.

The EoW of the Mumbai Police is already investigating several current and former senior executives of the bank, including former CEO Kathpalia and former deputy CEO Khurana, in connection with losses worth Rs 2,000 crore linked to mis-accounted internal derivative trades.

The Securities and Exchange Board of India (Sebi) is also investigating allegations of insider trading and misuse of unpublished price-sensitive information (UPSI) against Kathpalia and Khurana. According to a May 28 ex-parte interim order, both individuals were barred from trading in the securities market and asked to disgorge alleged illegal gains.

You may also like

NCLT Issues Notice To WinZO On Paytm's Insolvency Plea

Karnataka to set up five aerospace, defence parks: CM Siddaramaiah

'No fuss' Princess Anne spotted carrying her own luggage as she disembarks plane

Rachel Reeves considers allowing councils to impose more local taxes

Ryanair to stop flying from 'several' European airports in coming months