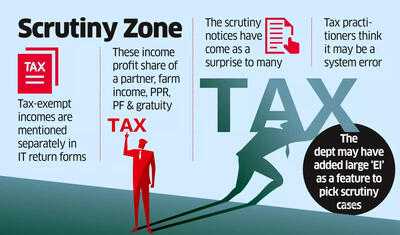

Mumbai: Several senior professionals, equity partners of at least two Big4 firms, members of well-known partnership ventures as well as some of the retired senior persons have received scrutiny notices from the Income tax (I-T) department questioning the amounts on which no tax was paid by them.

Most of these persons served with the notices for the financial year 2023-24 are understood to have shown these earnings as ' exempt income' in their I-T returns as is allowed under regulations.

Tax-exempt income (EI) can be of different types: profits shared by a firm to partners, agricultural income, disbursement of retirement benefits like provident fund and gratuity, the government-backed investment scheme like public provident fund (PPF) among others. While filing the ITR form, these are mentioned under Schedule EI of the ITR form so that such incomes are excluded from the computation of total income under Section 10 of the I-T Act, 1961.

Over the past one year, the tax office has been going after individuals who have fraudulently shown large amounts as farm income, or claimed benefits from bogus donations to little known political parties and fake rent receipts. But what surprised many is the current move to examine the veracity of receipts like partnership profits and full and final settlement amounts of retirees. Since a firm pays the tax, the profits distributed subsequently are not taxed in the hands of the partners. Some of the tax practitioners feel it could well be a system error which the I-T department needs to fix.

"Besides the compulsory selection criteria for scrutiny of ITRs, returns are also picked up based on certain risk parameters framed by the department. This year, claims of large amounts of exemption seems to have been one of the criteria for selection for scrutiny. Many partners of large professional partnership firms necessarily receive a share of profit from the firm which is exempt, as the remuneration paid by a firm to its partners cannot exceed 60% of its profits. Similarly, retiring employees receive gratuity and PF, which is exempt from tax up to certain limits. Many of these cases have also been picked up for scrutiny based on this new parameter. From the return, it is evident that the person is a partner of the firm or is claiming retirement benefits as exempt. Perhaps, application of a little bit of vetting or thought process may have helped avoid needless scrutiny of such genuine cases of claim of exemption," said Gautam Nayak, a senior tax professional and partner of the CA firm CNK & Associates LLP.

The scrutiny notices are issued a little over a year after the end of the financial year under review. The current set of notices, asking for a string of information like sources of income and documents to support the EI, were issued since mid-August.

According to Ashish Karundia, founder of the CA firm Ashish Karundia & Co, the intent behind Schedule EI is to promote transparency and facilitate comprehensive disclosure of such exempt income, and not to form the basis for initiating the scrutiny proceedings.

"Given that much of this information is already available with the tax department, initiating scrutiny solely based on disclosures made under Schedule EI, particularly under the category of 'other exempt income', may not align with the legislative framework. Such an approach risks placing an avoidable compliance burden on taxpayers who have reported their exempt income accurately and in accordance with the law." said Karundia.

Taxpayers who escape scrutiny notices (issued under section 143) may discover later that 'reassessment proceedings' (under section 148) have been initiated against them. The department has a longer timeframe in issuing reassessment notices, particularly if the escaped income is more than ₹50 lakh.

"It's essential that no adverse inferences are drawn merely from the reporting of exempt income in this schedule where its exempt status is clearly supported. Equally important is that any questionnaires issued to taxpayers as part of scrutiny proceedings be relevant, specific, and appropriately tailored to the facts of the case. This would be consistent with the guidance issued by the Central Board of Direct Taxes (CBDT) earlier this year, aiming to ensure that inquiries remain focused and proportionate," said Karundia.

While most grappling with the scrutiny notices would probably be able to defend their claims, they would have to nonetheless go through the rigmarole of dealing with the department.

Most of these persons served with the notices for the financial year 2023-24 are understood to have shown these earnings as ' exempt income' in their I-T returns as is allowed under regulations.

Tax-exempt income (EI) can be of different types: profits shared by a firm to partners, agricultural income, disbursement of retirement benefits like provident fund and gratuity, the government-backed investment scheme like public provident fund (PPF) among others. While filing the ITR form, these are mentioned under Schedule EI of the ITR form so that such incomes are excluded from the computation of total income under Section 10 of the I-T Act, 1961.

Over the past one year, the tax office has been going after individuals who have fraudulently shown large amounts as farm income, or claimed benefits from bogus donations to little known political parties and fake rent receipts. But what surprised many is the current move to examine the veracity of receipts like partnership profits and full and final settlement amounts of retirees. Since a firm pays the tax, the profits distributed subsequently are not taxed in the hands of the partners. Some of the tax practitioners feel it could well be a system error which the I-T department needs to fix.

"Besides the compulsory selection criteria for scrutiny of ITRs, returns are also picked up based on certain risk parameters framed by the department. This year, claims of large amounts of exemption seems to have been one of the criteria for selection for scrutiny. Many partners of large professional partnership firms necessarily receive a share of profit from the firm which is exempt, as the remuneration paid by a firm to its partners cannot exceed 60% of its profits. Similarly, retiring employees receive gratuity and PF, which is exempt from tax up to certain limits. Many of these cases have also been picked up for scrutiny based on this new parameter. From the return, it is evident that the person is a partner of the firm or is claiming retirement benefits as exempt. Perhaps, application of a little bit of vetting or thought process may have helped avoid needless scrutiny of such genuine cases of claim of exemption," said Gautam Nayak, a senior tax professional and partner of the CA firm CNK & Associates LLP.

The scrutiny notices are issued a little over a year after the end of the financial year under review. The current set of notices, asking for a string of information like sources of income and documents to support the EI, were issued since mid-August.

According to Ashish Karundia, founder of the CA firm Ashish Karundia & Co, the intent behind Schedule EI is to promote transparency and facilitate comprehensive disclosure of such exempt income, and not to form the basis for initiating the scrutiny proceedings.

"Given that much of this information is already available with the tax department, initiating scrutiny solely based on disclosures made under Schedule EI, particularly under the category of 'other exempt income', may not align with the legislative framework. Such an approach risks placing an avoidable compliance burden on taxpayers who have reported their exempt income accurately and in accordance with the law." said Karundia.

Taxpayers who escape scrutiny notices (issued under section 143) may discover later that 'reassessment proceedings' (under section 148) have been initiated against them. The department has a longer timeframe in issuing reassessment notices, particularly if the escaped income is more than ₹50 lakh.

"It's essential that no adverse inferences are drawn merely from the reporting of exempt income in this schedule where its exempt status is clearly supported. Equally important is that any questionnaires issued to taxpayers as part of scrutiny proceedings be relevant, specific, and appropriately tailored to the facts of the case. This would be consistent with the guidance issued by the Central Board of Direct Taxes (CBDT) earlier this year, aiming to ensure that inquiries remain focused and proportionate," said Karundia.

While most grappling with the scrutiny notices would probably be able to defend their claims, they would have to nonetheless go through the rigmarole of dealing with the department.

You may also like

Trump blames 'radical Left' after Charlie Kirk's murder

"Rs 15-20 crores reportedly spent on each person": Abhishek Banerjee alleges attempts to buy votes in Vice President poll

DWP PIP assessment update for people with these conditions

Passengers deplaned from Air India's Singapore-bound plane at Delhi airport

"Devotion to God and patriotism inseparable in India": RSS chief Mohan Bhagwat