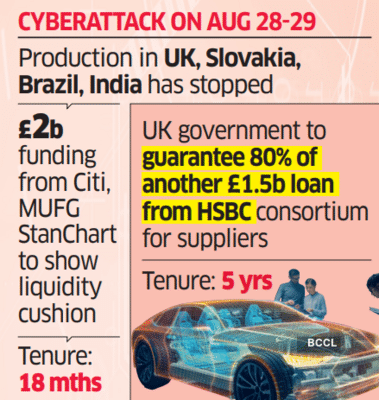

Tata Group-owned Jaguar Land Rover ( JLR) has sought £2 billion emergency funding from a handful of global banks in the aftermath of the late August cyberattack that left the car maker, also Britain's largest automotive employer, largely incapacitated, said people aware of the matter.

The 18-month facility with committed backstop arrangements is expected to show the company has liquidity to tide over the loss in revenue after it was forced to hit the brakes and shut down its systems and UK factories on September 1. Since then, production at its factories in the UK, Slovakia, Brazil and even India have come to a standstill. Its Chinese joint venture however is said to be operating.

At least three of the Tata Group's top banking partners - Standard Chartered Bank, Citi and MUFG - have agreed to offer the urgent credit line and subsequently sell down or syndicate the debt to a larger group.

Political Intervention

The pricing is still being negotiated, added the people mentioned above.

In addition, the UK government announced over the weekend it will guarantee or underwrite a £1.5 billion loan given by another commercial banking consortium led by HSBC to JLR.

This line, to be paid back over five years, is expected to allay fears of suppliers who fear going bust if the sudden revenue drought continues.

The UK government will guarantee 80% of the facility under the Export Credit Guarantee Scheme while the banks will have to bear the remaining 20%.

“It’s a political intervention, which is why a UK bank had to take the lead,” said an executive. “Together, this is a significant credit going out in the market. Nobody knows if we are looking at significant losses in future or ratings downgrades.”

A Tata Motors spokesperson declined to comment.

As per initial estimates, the shutdown was expected to last until September 24, but it was later extended to October 1, causing a long production stoppage. Parent Tata Motors shares dropped nearly 5% last week, though it ended trading on Friday in the green, up 1.45%, on the NSE. A halt in production until November could lead to a revenue impact upwards of £3.5 billion and about £1.3 billion in gross profit, according to academics and industry experts in the UK. Even a conservative estimate will translate to a £2 billion financial hit that the luxury car maker will have to bear for months before production normalises. This is higher than JLR's net profit of £1.8 billion for the full 2025 financial year. JLR contributes 70% to the Tata Motors overall top line.

The company employs 30,000 directly with about 100,000 people at its vendors, according to the BBC, which reported that a group calling itself Scattered Lapsus$ Hunters claimed responsibility for the attack that froze JLR’s IT systems and is said to be costing it at least £50 million a week in lost production.

JLR’s turnaround under Tata has resulted in 11 consecutive quarters of profits, despite tariffs and global instability prompted by Russia’s invasion of Ukraine.

Grinding halt

The severity of the cyberattack has caused turmoil across the supply chain, particularly in the UK around headquarters in Gaydon and the Solihull factory, where it makes the money-spinning Range Rovers. With little hope of an imminent restart, JLR suppliers and dealers fear production in the UK may not resume for several months, thereby compounding stress on the books.

“Tata Motors officials are leading the negotiations. The fact that they are driving it is enough of a comfort factor,” said an executive.

It’s unclear if Tata Motors or parent Tata Sons will be willing to give a formal guarantee against the credit line but company officials say that seems unlikely.

“We are expecting normalcy to return by November. It’s a fluid situation that is changing every hour,” said an executive involved in the financing negotiations.

Government aid

It was earlier reported that the UK government’s business secretary Peter Kyle was considering an unusual scheme under which the government could purchase car components from struggling suppliers that would later be sold to JLR once it resumed production. Over the last week, he held a series of emergency meetings with JLR suppliers struggling to meet payments as political pressure mounts to arrive at a solution.

There have been reports that lack of cyber insurance will mean the company having to foot the bill. This could not be independently verified.

Even though the computer-aided design, engineering software and product lifecycle software were down last week, the company has implemented workarounds to make payments and ship cars to customers. It has focused on keeping existing customers happy with a flow of spare parts.

According to a report in Sunday Times, the company is planning to reopen its £500 million engine manufacturing centre in early October. It reported the company has put suppliers on notice that production at its Wolverhampton facility will resume on October 6, subject to the engine manufacturing centre systems passing tests to ensure no remnants of the virus exist.

Group company Tata Consultancy Services (TCS) has been helping JLR minimise the damage. Under a five-year, £800 million contract agreed in 2023, TCS and JLR planned to “rapidly transform, simplify, and manage its digital and IT estate, supporting its broader strategic business transformation”. TCS runs large parts of JLR’s key computer systems, ranging from its networks to data connections, and, crucially, its cybersecurity.

The 18-month facility with committed backstop arrangements is expected to show the company has liquidity to tide over the loss in revenue after it was forced to hit the brakes and shut down its systems and UK factories on September 1. Since then, production at its factories in the UK, Slovakia, Brazil and even India have come to a standstill. Its Chinese joint venture however is said to be operating.

At least three of the Tata Group's top banking partners - Standard Chartered Bank, Citi and MUFG - have agreed to offer the urgent credit line and subsequently sell down or syndicate the debt to a larger group.

Political Intervention

The pricing is still being negotiated, added the people mentioned above.

In addition, the UK government announced over the weekend it will guarantee or underwrite a £1.5 billion loan given by another commercial banking consortium led by HSBC to JLR.

This line, to be paid back over five years, is expected to allay fears of suppliers who fear going bust if the sudden revenue drought continues.

The UK government will guarantee 80% of the facility under the Export Credit Guarantee Scheme while the banks will have to bear the remaining 20%.

“It’s a political intervention, which is why a UK bank had to take the lead,” said an executive. “Together, this is a significant credit going out in the market. Nobody knows if we are looking at significant losses in future or ratings downgrades.”

A Tata Motors spokesperson declined to comment.

As per initial estimates, the shutdown was expected to last until September 24, but it was later extended to October 1, causing a long production stoppage. Parent Tata Motors shares dropped nearly 5% last week, though it ended trading on Friday in the green, up 1.45%, on the NSE. A halt in production until November could lead to a revenue impact upwards of £3.5 billion and about £1.3 billion in gross profit, according to academics and industry experts in the UK. Even a conservative estimate will translate to a £2 billion financial hit that the luxury car maker will have to bear for months before production normalises. This is higher than JLR's net profit of £1.8 billion for the full 2025 financial year. JLR contributes 70% to the Tata Motors overall top line.

The company employs 30,000 directly with about 100,000 people at its vendors, according to the BBC, which reported that a group calling itself Scattered Lapsus$ Hunters claimed responsibility for the attack that froze JLR’s IT systems and is said to be costing it at least £50 million a week in lost production.

JLR’s turnaround under Tata has resulted in 11 consecutive quarters of profits, despite tariffs and global instability prompted by Russia’s invasion of Ukraine.

Grinding halt

The severity of the cyberattack has caused turmoil across the supply chain, particularly in the UK around headquarters in Gaydon and the Solihull factory, where it makes the money-spinning Range Rovers. With little hope of an imminent restart, JLR suppliers and dealers fear production in the UK may not resume for several months, thereby compounding stress on the books.

“Tata Motors officials are leading the negotiations. The fact that they are driving it is enough of a comfort factor,” said an executive.

It’s unclear if Tata Motors or parent Tata Sons will be willing to give a formal guarantee against the credit line but company officials say that seems unlikely.

“We are expecting normalcy to return by November. It’s a fluid situation that is changing every hour,” said an executive involved in the financing negotiations.

Government aid

It was earlier reported that the UK government’s business secretary Peter Kyle was considering an unusual scheme under which the government could purchase car components from struggling suppliers that would later be sold to JLR once it resumed production. Over the last week, he held a series of emergency meetings with JLR suppliers struggling to meet payments as political pressure mounts to arrive at a solution.

There have been reports that lack of cyber insurance will mean the company having to foot the bill. This could not be independently verified.

Even though the computer-aided design, engineering software and product lifecycle software were down last week, the company has implemented workarounds to make payments and ship cars to customers. It has focused on keeping existing customers happy with a flow of spare parts.

According to a report in Sunday Times, the company is planning to reopen its £500 million engine manufacturing centre in early October. It reported the company has put suppliers on notice that production at its Wolverhampton facility will resume on October 6, subject to the engine manufacturing centre systems passing tests to ensure no remnants of the virus exist.

Group company Tata Consultancy Services (TCS) has been helping JLR minimise the damage. Under a five-year, £800 million contract agreed in 2023, TCS and JLR planned to “rapidly transform, simplify, and manage its digital and IT estate, supporting its broader strategic business transformation”. TCS runs large parts of JLR’s key computer systems, ranging from its networks to data connections, and, crucially, its cybersecurity.

You may also like

Michigan church shooting: 2 killed, 8 injured as gunman opens fire on worshippers - what we know so far

Lost contact with 2 hostages: Hamas; 77 killed in 24 hrs, says Gaza ministry

UN arms embargo, other sanctions reimposed on Iran over its N-plans

Groww, PhonePe, PhysicsWallah And A New Era Of Startup IPOs

Championing Oral Health, Colgate Has Transformed Toothpaste Into a Movement