New Delhi | Mumbai: Global venture fund Norwest Venture Partners (NVP) is leading negotiations to buy into homegrown dessert and waffle chain The Belgian Waffle Co, after talks with ChrysCapital fell through last year, said people directly aware of the developments. A potential deal is expected to value Belgian Waffle at '350-500 crore, the people said.

They did not disclose the size of the stake NVP is looking to buy.

"Fresh negotiations are underway with NVP, to sell minority equity in the business, since the promoters don't want to sell a majority stake as of now, which was why the deal with ChrysCapital did not work out," one of the persons said. "However, given that investor interest is picking up in the dining-out space and there are signs of revival in the sector, negotiations have been revived."

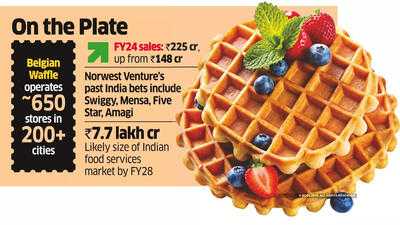

Started in 2015 by entrepreneur couple Shrey and Alisha Aggarwal, Belgian Waffle's ownership rests with their company Bloombay Enterprises. It currently has about 650 stores operational in more than 200 cities across India.

The chain reported revenue of Rs 225 crore in FY24, rising from Rs 148 crore in the previous year, according to company filings.

"While Lighthouse Funds too has been in the fray to acquire a minority stake in Belgian Waffle, as of now NVP is leading the negotiations," said the person cited above.

Backed by US financial giant Wells Fargo, NVP, an early to mid-stage fund, has invested in India in several sectors spanning consumer, healthcare, IT services and financial services. It includes companies such as Swiggy, Mensa Brands, Five Star Finance, and Amagi Media Labs.

Belgian Waffle, NVP, and Lodha Capital Markets, which is handling the talks on behalf of the waffle chain, declined to comment.

While most of its outlets are in the cafe format, Belgian Waffle also operates through kiosks and takeaways. Its operating structure is a mix of company-owned and franchisee-led formats. It also sells on Swiggy and Zomato.

Belgian Waffle has also expanded to spreads and pre-mix categories, mirroring strategies of various quick service restaurants and cafe chains entering the ready-to-eat business to fuel sales in a subdued market. The potential Belgian Waffle deal would track homegrown private equity firm ChrysCapital acquiring around 85% stake in pan-India bakery chain Theobroma Foods for Rs 2,410 crore.

Various specialised cafes and patisserie brands are entering India or adding new stores. These include Canada's Tim Hortons, Belgian chain Le Pain Quotidien, French patisserie brand Laduree, Reliance Brands-backed Armani/Caffe and Pret a Manger.

They did not disclose the size of the stake NVP is looking to buy.

"Fresh negotiations are underway with NVP, to sell minority equity in the business, since the promoters don't want to sell a majority stake as of now, which was why the deal with ChrysCapital did not work out," one of the persons said. "However, given that investor interest is picking up in the dining-out space and there are signs of revival in the sector, negotiations have been revived."

Started in 2015 by entrepreneur couple Shrey and Alisha Aggarwal, Belgian Waffle's ownership rests with their company Bloombay Enterprises. It currently has about 650 stores operational in more than 200 cities across India.

The chain reported revenue of Rs 225 crore in FY24, rising from Rs 148 crore in the previous year, according to company filings.

"While Lighthouse Funds too has been in the fray to acquire a minority stake in Belgian Waffle, as of now NVP is leading the negotiations," said the person cited above.

Backed by US financial giant Wells Fargo, NVP, an early to mid-stage fund, has invested in India in several sectors spanning consumer, healthcare, IT services and financial services. It includes companies such as Swiggy, Mensa Brands, Five Star Finance, and Amagi Media Labs.

Belgian Waffle, NVP, and Lodha Capital Markets, which is handling the talks on behalf of the waffle chain, declined to comment.

While most of its outlets are in the cafe format, Belgian Waffle also operates through kiosks and takeaways. Its operating structure is a mix of company-owned and franchisee-led formats. It also sells on Swiggy and Zomato.

Belgian Waffle has also expanded to spreads and pre-mix categories, mirroring strategies of various quick service restaurants and cafe chains entering the ready-to-eat business to fuel sales in a subdued market. The potential Belgian Waffle deal would track homegrown private equity firm ChrysCapital acquiring around 85% stake in pan-India bakery chain Theobroma Foods for Rs 2,410 crore.

Various specialised cafes and patisserie brands are entering India or adding new stores. These include Canada's Tim Hortons, Belgian chain Le Pain Quotidien, French patisserie brand Laduree, Reliance Brands-backed Armani/Caffe and Pret a Manger.

You may also like

Major inheritance tax change talks as Sky News host grills minister on plan

Meet Alexander Isak's controversial agent who FIFA investigated and brokered Chelsea deals

Woman, 45, second to die after eating 'toxic broccoli' in Italy as veg recalled

Ex-IndusInd Bank Dy CEO faces EOW probe over Rs 1,960 crore accounting lapse: Report

UP B.ED Counseling 2025: UP B.ED Counseling Round 2 Seat Allotment Result will be released tomorrow..