India’s public markets were buzzing in October, with 14 IPOs hitting D-Street and collectively raising over INR 46,000 Cr. The momentum is far from slowing down, and November is shaping up to be another blockbuster month for public listings, with companies across sectors expected to mobilise upwards of INR 75,000 Cr.

New-age tech companies are a key factor in this fresh wave of listings. After the highs of Urban Company, Lenskart opened its IPO for subscription last week, and now all eyes are now on Groww.

It will be the first investment tech startup to make a public market debut, and it will also be one of the most highly anticipated IPOs for investors, many of whom use Groww to invest and track their portfolio.

The issue opens for subscription tomorrow and ahead of the subscription, the grey market premium touched a high of INR 15 on November 3, 2025. This indicates a listing price of INR 115 apiece or a premium of 15% on the upper limit of the price band i.e INR 100.

But the public issue arrives at a moment when investor bandwidth is being tested. Liquidity is rotating into secondary markets, large-cap offerings are competing for attention, and the question naturally arises — is Groww’s timing optimal, or will investor appetite be stretched thin?

Groww’s Crowded IPO TestThe company aims to raise INR 6,632.3 Cr from its maiden public issue. The mainline offering comprises a combination of a fresh issue of 106 Mn equity shares and an offer for sale (OFS) of 55.2 Mn equity shares.

Under the OFS, investors Peak VI Partners Investments, YC Holdings II, Ribbit Capital V, and GW-E Ribbit Opportunity V, among others will be offloading part of their holdings.

The implied valuation of INR 61,700 Cr at the higher end of the price band, means Groww is asking for a big premium in a crowded window where several large issues are waiting in the wings. The likes of Pine Labs, Meesho, PhysicsWallah, Shadowfax, Shiprocket among others are also expected to list before the year closes.

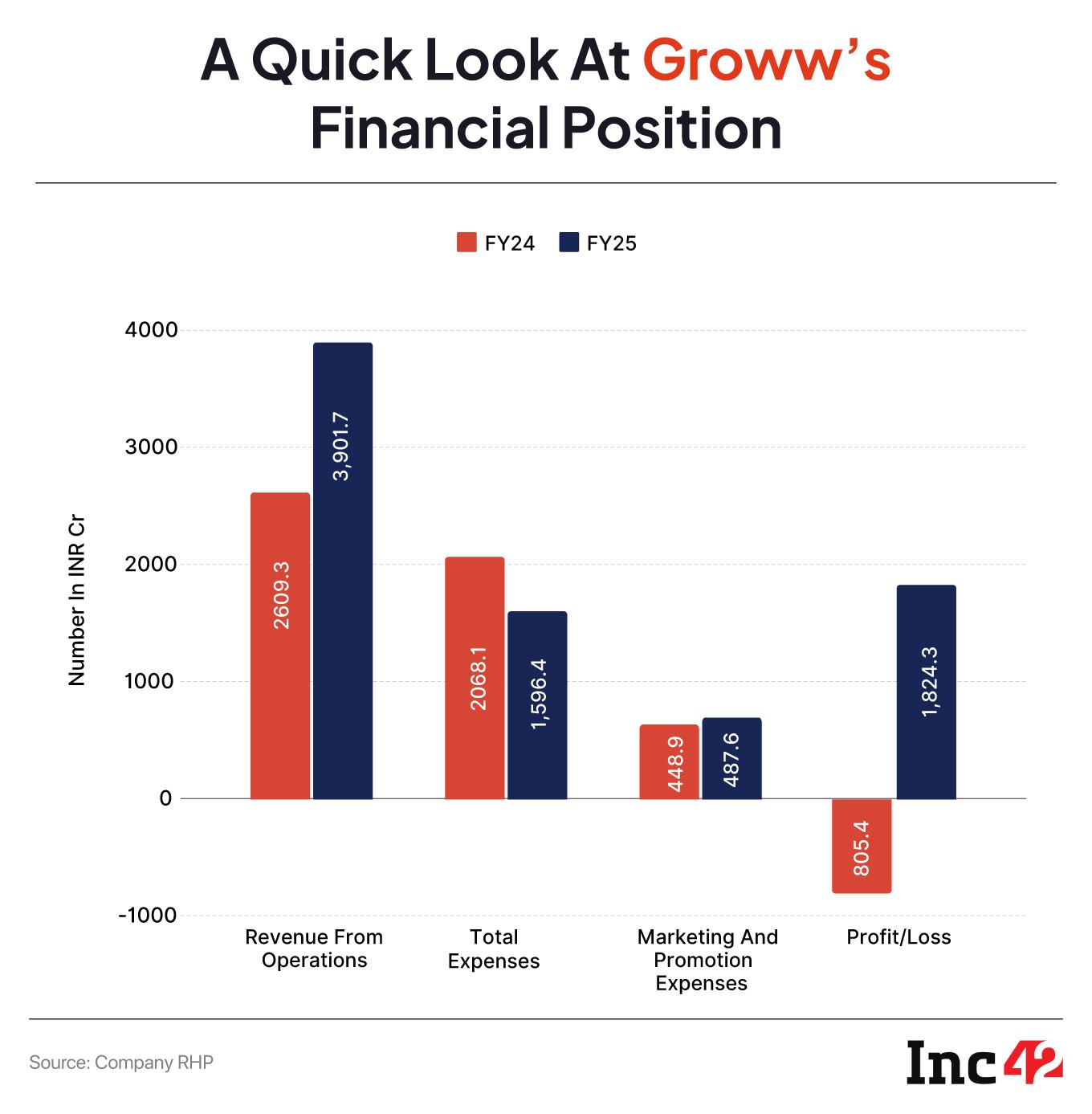

According to market analysts, Groww’s story is appealing because it turned profitable quickly and scaled rapidly to overtake Zerodha and Angel One.

“The last fiscal year (FY25) marked its transition to strong profitability with robust margins, giving management the confidence to test public markets despite a tightening liquidity backdrop,” said Sourav Choudhary, Managing Director, Raghunath Capital.

After hitting profits in FY25, Groww also recorded a 12% year-on-year increase in its consolidated net profit for Q1 FY26, rising to INR 378.4 Cr from INR 338 Cr in the corresponding period last year.

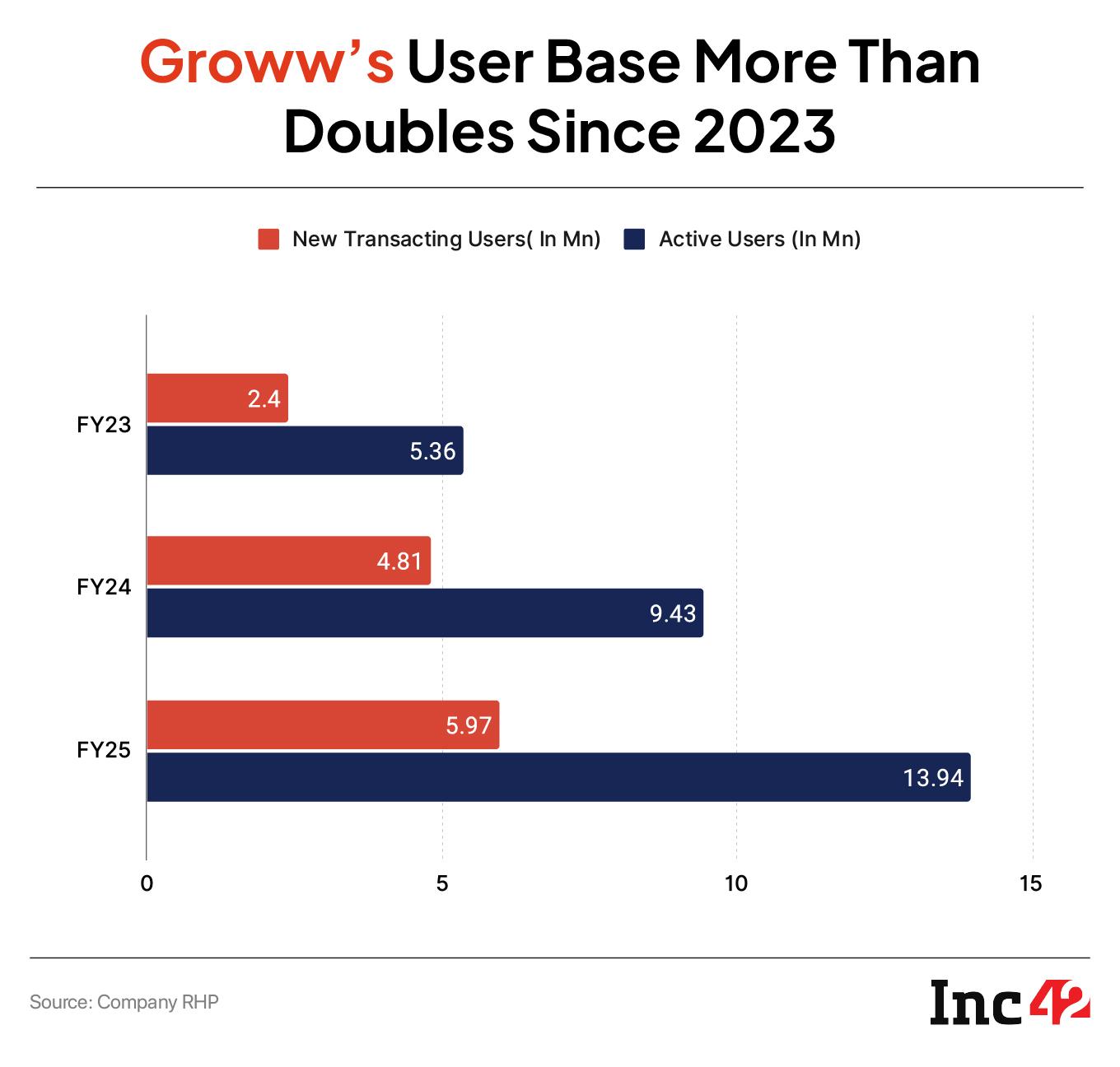

Moreover, Groww has shown consistency in retaining users — a fast-expanding retail investor pool and its dominance among active NSE users position the company well to capture more of the new investor base

While the grey market premium (GMP) points to a healthy pre-listing sentiment, given the heavy retail participation and momentum chasing in recent IPOs, it could be indicative of speculative build-up rather than sustainable demand, as per analysts.

“With a large OFS component, early supply could easily absorb this premium unless institutional anchor demand proves deep and sticky,” Choudhary added.

Valuation Under ScrutinyLike in the case of Lenskart, there are some concerns about Groww’s valuation. While investor sentiment remains buoyant, at an earnings multiple north of 31x, Groww is commanding a clear growth premium over its listed peers.

For example, Angel One is profitable and trades at significantly lower multiples despite delivering stronger return ratios. It boasts a return on equity of around 28%.

“Scalability, technology leverage, and a younger demographic base are on Groww’s side. The question is whether these attributes can sustain a multiple typically reserved for high-margin tech platforms rather than regulated brokers. For now, investors are paying for future optionality, not just present earnings,” the Raghunath Capital MD added.

The relatively high valuation also invites scrutiny as traditional brokers continue to post superior financial efficiency at a fraction of the valuation, an analyst at a leading brokerage firm noted.

The broader broking and fintech landscape is navigating a structural overhang. SEBI’s restrictions on weekly expiries and tighter futures and options (F&O) segment regulations have begun to weigh on derivative volumes, a critical profit pool for most discount brokers.

As the regulator nudges retail investors towards prudence, platforms heavily dependent on F&O churn could face margin compression.

Moreover, across the market, the notional average daily turnover (ADTO) in F&O contracted by approximately 38.07% between June 2024 and June 2025, with a 36.31% dip in individual investor participation. The growth in derivatives trading is expected to moderate in the short term driven by regulatory measures introduced by SEBI, which Groww itself has noted in its RHP.

But the company expects that it will benefit from the changing regulatory environment as it is likely to attract more informed and sophisticated investors, while potentially increasing the average turnover per investor.

The story now moves from numbers to conviction: who backs Groww at the starting line will define how it trades beyond day one.

The anchor round is expected to draw a blend of global tech and fintech-focused institutions along with domestic long-only funds. The composition of this book will be crucial in determining post-listing performance, according to analysts.

Should domestic long-only investors take the lead, Groww could benefit from greater stability in its early trading sessions. Conversely, if short-horizon hedge and PE funds dominate the anchor list, early profit-taking may cap listing gains.

Notably, major existing investors such as Peak XV Partners, Ribbit Capital, and Y Combinator getting partial exits and placing greater responsibility on new institutional investors to absorb supply. But sources close to the company have told Inc42 that almost none of the investors wanted to sell shares, but the IPO regulations have more or less compelled the company to have a large OFS component.

The OFS enhances float liquidity and broadens participation, it also introduces the risk of immediate supply pressure. Without strong anchor and qualified institutional buyer (QIB) support, Groww’s initial trading sessions could see volatility and profit-taking. But this is a worst case scenario.

Despite these near-term risks, Groww’s broader ambitions remain clear. The company aims to strengthen its pan-India brand around trust, transparency, and financial inclusion, without burning cash while maintaining operating leverage.

If the anchor book showcases conviction from long-term funds, Groww could set a new benchmark for new-age fintech listings. If not, it risks becoming a case study in valuation overshoot amid liquidity fatigue. Either way, Groww’s debut will shape how India prices fintech ambition for years to come.

[Edited by Nikhil Subramaniam]

The post Can Groww Justify Its Valuation In A Crowded IPO Season? appeared first on Inc42 Media.

You may also like

Rohit Sharma's doppelganger trains Harmanpreet Kaur for iconic World Cup trophy walk - WATCH

Arsenal braced for Bayern Munich suspension blow as huge Mikel Arteta worry clear

Four in ten Brits living in 'stress-inducing' levels of clutter but 1 thing could help

Wes Streeting sparks outrage with 'tone deaf' post after Huntingdon attack

Can Groww Justify Its Valuation In A Crowded IPO Season?