Eternal’s Q2 results told a story of stark contrasts. Despite soaring revenues, the consumer services giant’s profits nosedived due to rising expenses and Blinkit’s inventory-led pivot, which cost the parent dearly.

Here are the key takeaways from Eternal’s Q2 FY26 show:

- Net profit plunged 63% YoY to INR 65 Cr

- Operating revenue soared 183% YoY to INR 13,590 Cr

- Total expenses zoomed 189% YoY to INR 13,813 Cr

- Zomato revenue rose 24% YoY to INR 2,485 Cr, and profits jumped 49% YoY to INR 518 Cr.

- Blinkit’s revenue skyrocketed 8.5X YoY to INR 9,891 Cr while profits declined 90% YoY to INR 5 Cr

- Hyperpure’s revenue fell 31% YoY to INR 1,023 Cr, with a profit of INR 1 Cr compared to a loss of INR 4 Cr in the year-ago quarter.

Zomato Crawls Back To Growth: Eternal’s core food delivery business showed a measured recovery after five quarters of deceleration. Zomato’s profitability improved thanks to higher ad monetisation and platform fees, but the segment faces headwinds from weak consumer spending and cannibalisation by quick commerce.

Blinkit’s Expansion Blitz: The quick commerce vertical was the primary revenue engine and the source of surging costs. The topline surge came on the back of aggressive expansion and 272 new dark stores. This growth, however, consumed over 90% of Eternal’s capital expenditure, averaging INR 1 Cr per store.

Hyperpure Takes A Hit: Blinkit’s pivot directly impacted Hyperpure. Its revenue withered as its non-restaurant business collapsed by 90% YoY, a stream expected to hit zero in the coming quarters. However, Eternal anticipates the B2B vertical’s core restaurant supply segment to grow and achieve profitability within two quarters.

As Eternal reshapes itself around Blinkit, will this bet create a profitable behemoth, or will the costs prove too high? While that is a question for another day, here is how Eternal fared in Q2.

From The Editor’s Desk Zepto’s $7 Bn Valuation Sprint

Zepto’s $7 Bn Valuation Sprint

- Zepto raised $450 Mn (INR 3,955 Cr) in a new round led by CalPERS, valuing the quick commerce startup at $7 Bn, up from $5 Bn in 2024. The round gives Zepto about $900 Mn in net cash, boosting its war chest as it looks to regain market share from Blinkit.

- Zepto has scaled order volumes 200% over the past 18 months, while making more of its dark stores profitable. However, its Zepto Café unit has faced headwinds, shutting around 50 outlets due to sourcing and staffing issues. The company also pushed back its IPO plans to focus on private fundraising.

- Zepto’s latest raise comes amid fierce competition in India’s $5 Bn quick commerce market, dominated by Blinkit. Despite a 149% surge in revenue to INR 11,100 Cr in FY25, the Aadit Palicha-led startup is still loss-making, posting INR 1,248 Cr loss in FY24.

Ola Electric Looks To Power Homes

Ola Electric Looks To Power Homes - Ola Electric has launched Ola Shakti, a residential battery energy storage system using its 4680 Bharat Cell technology, with deliveries starting January 2026.

- It offers four configurations ranging from 1kW/1.5kWh at INR 29,999 to 6kW/9.1kWh at INR 1.6 Lakh, capable of powering ACs, fridges, induction cookers, and farm pumps.

- With EV adoption slower than expected and revenue declining 50% YoY in Q1 FY26, Ola Shakti allows the EV giant to monetise its battery capacity, compete with rivals like Ather Energy, and stabilise its business.

Swiggy’s Pyng Goes Bust

Swiggy’s Pyng Goes Bust - Six months after its launch, Swiggy is closing its professional services marketplace, Pyng, by the end of October. The platform connected users with experts like financial advisors, wellness professionals, and astrologers.

- The foodtech giant cited an unviable business model as the reason for the shutdown. It stated that the balance between high customer acquisition costs and long-term retention was not sustainable.

- Swiggy’s latest shutdown follows the suspension of its hyperlocal delivery service, Genie, and its D2C SaaS platform, Minis.

- Jio Financial Services reported a flat Q2 FY26 profit of INR 695 Cr, while revenue surged 42% YoY to INR 981 Cr, led by strong growth across lending, payments, and asset management.

- Interest income remained the top contributor at INR 392 Cr, followed by gains from fair value changes and dividend income. Total expenses spiked 68% QoQ to INR 436 Cr as the company continued scaling operations.

- Since its listing in 2023, JFS has been rapidly diversifying into credit, insurance, and asset management, positioning itself as a full-stack fintech under Reliance Industries.

Kuku FM’s $85 Mn Buffet

Kuku FM’s $85 Mn Buffet - Kuku FM raised $85 Mn in its Series C round to expand premium content, produce celebrity-driven shows, and leverage its in-house GenAI studio for faster, cost-efficient production.

- Founded in 2018, Kuku FM hosts audiobooks, podcasts, and original shows in 14 languages, with over 100 Mn app downloads and 10 Mn paid subscribers. It recently entered the microdrama arena via Kuku TV.

- The investment comes amid rising interest in India’s audio OTT space, projected to grow at a 16% CAGR to $119 Bn by FY27. The funding positions Kuku FM to compete aggressively with rivals like Pocket FM.

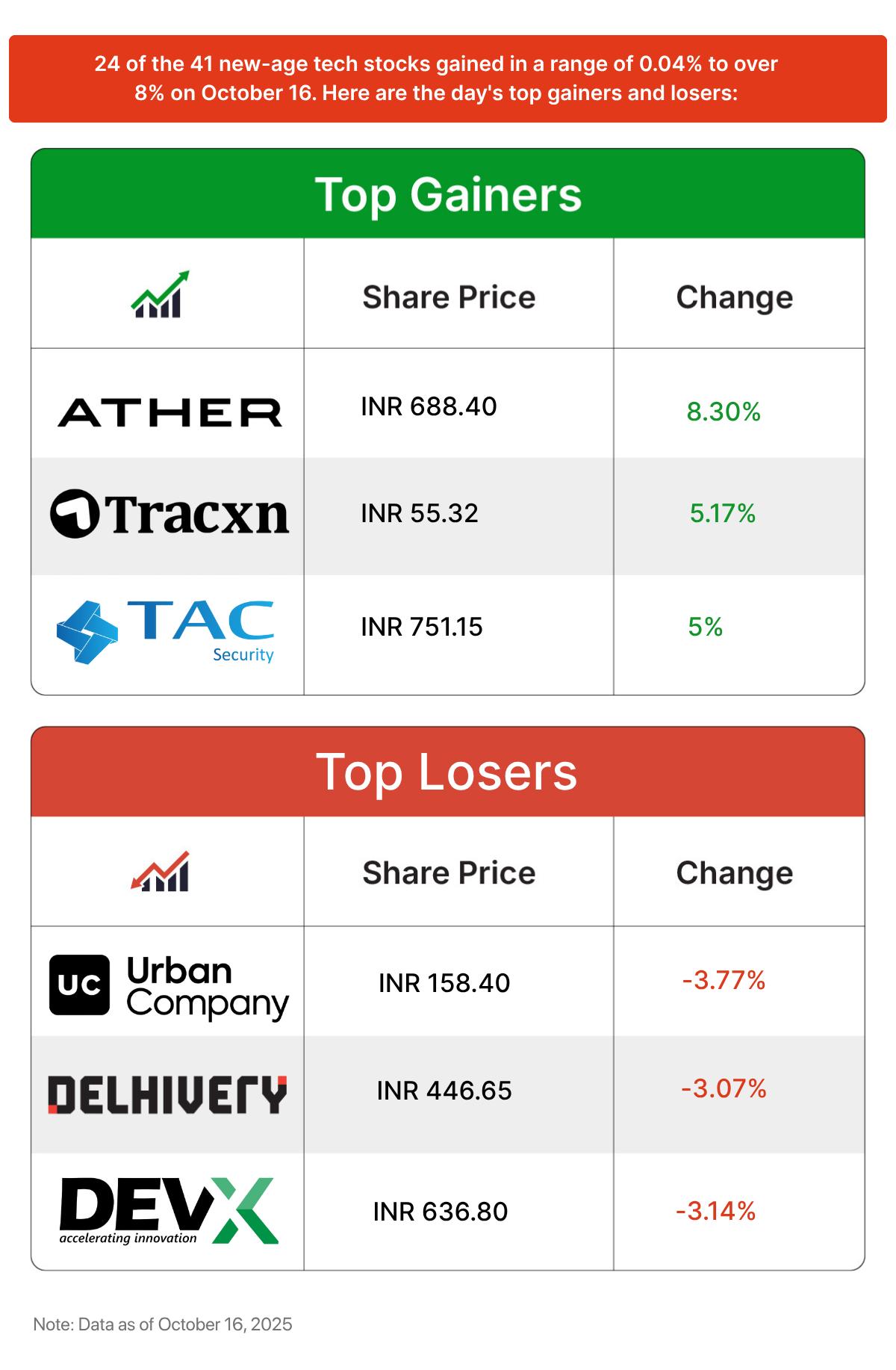

TAC Infosec Doubles PAT

TAC Infosec Doubles PAT - TAC Infosec reported H1 FY26 net profit of INR 15.6 Cr, up 138% YoY, with revenue jumping 137% YoY to INR 29.5 Cr. The top line jump came on the back of strong sales of its SaaS cybersecurity solutions and risk-based vulnerability management offerings.

- Founded in 2016, TAC Infosec serves over 3,000 clients, including Google, Nissan, Salesforce, and Zepto. Its product suite targets enterprise and SMB cybersecurity needs, positioning it as a leading vulnerability management provider.

- With a 1:1 bonus share issue and a goal of 10,000 clients by 2026, TAC Infosec is aggressively expanding globally with acquisitions in Europe, the UAE, and the US, and establishing a UK subsidiary.

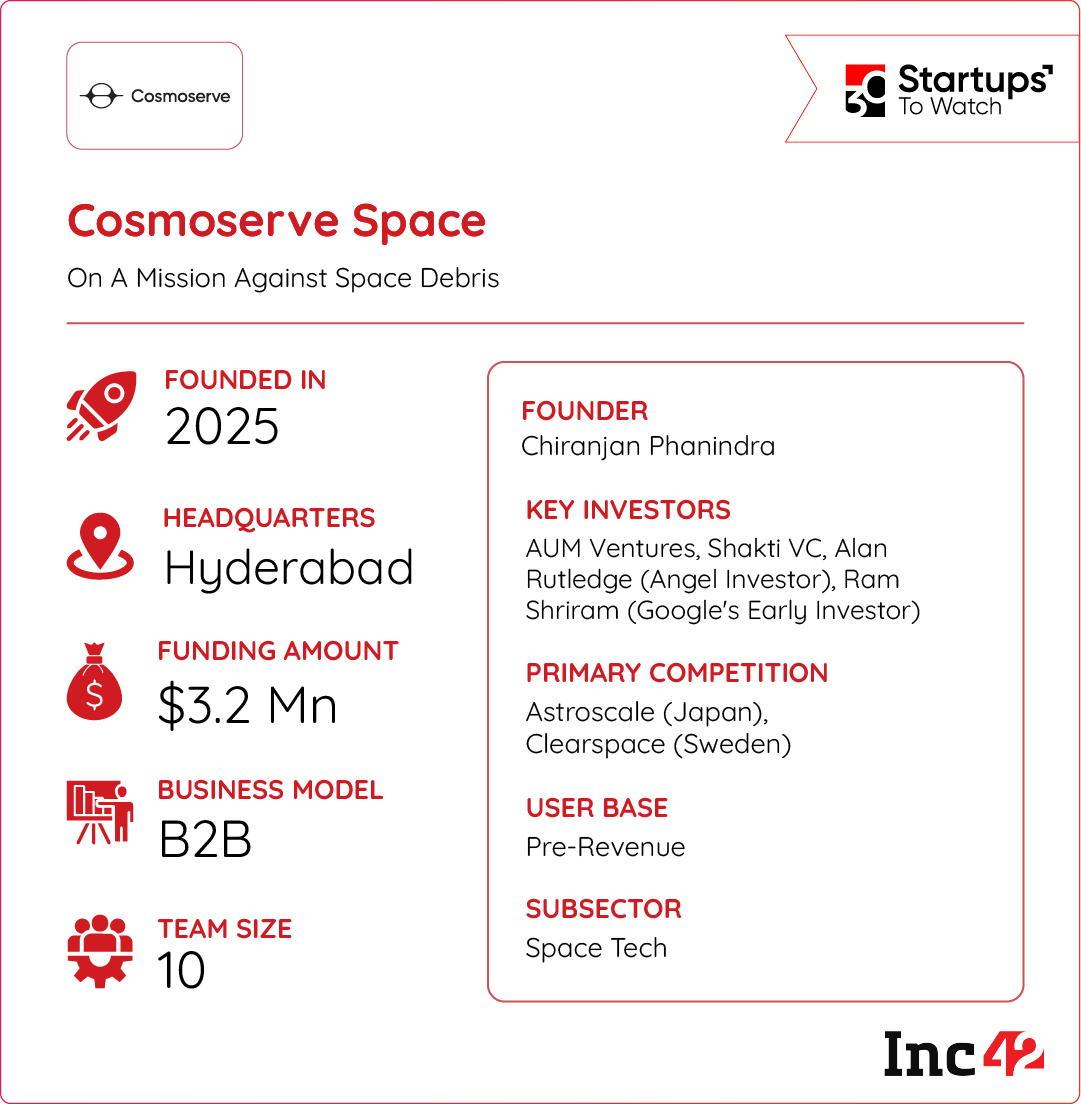

With tens of thousands of debris objects orbiting Earth at high speeds, the risk of catastrophic collisions threatens active satellites and future missions. Enter Cosmoserve Space, a startup dedicated to cleaning Earth’s orbit with robots.

A Cosmic Cleanup Crew: Founded in 2025, the startup is developing a retriever spacecraft, which is designed to identify, track, capture, and safely de-orbit dangerous space junk. This ensures operational safety for India’s burgeoning space economy.

A Multi-Billion Dollar Mess: Going forward, the startup plans to build ground-testing facilities, with an in-space demonstration planned for late 2026. Once regulatory approvals and tests are complete, Cosmoserve aims to serve government space agencies, private satellite operators, and commercial space enterprises worldwide.

With the global space debris removal industry projected to cross $2 Bn by 2033. Cosmoserve is positioning itself to capture a significant share of this emerging sector with a robust founding team and a clear mission.

But as it navigates complex regulations and technical hurdles, can Cosmoserve successfully turn space junk into a sustainable business?

Behind every 10-minute delivery, there’s a tech-powered engine at work. Meet the startups building India’s quick commerce future, from dark stores to AI-driven logistics — scaling instant gratification beyond metros.

The post Eternal’s Q2 Paradox, Zepto’s $7 Bn Valuation Sprint & More appeared first on Inc42 Media.

You may also like

'You are a pig Trump': Hackers breach several airports in US, Canada; pro-Hamas messages flashed

New York City mayoral debate: Mamdani on past 'defund police' stance; now calls on Hamas to disarm, clarifies Israel position

Sonakshi Sinha's reaction to her pregnancy rumours is hilarious

Rohit, Virat Hit Nets In Perth, Share Light Moments Ahead Of ODI Series Opener

7 Unique Ideas to Make Your Diwali 2025 Party Unforgettable