For over 5,000 years, man has been praying for prosperity at the sight of a shooting star. That’s where Oolka positions itself.

“When people see a shooting star, they make a wish. For an adult, the wish is usually of financial safety and improvement. Oolka wants to fulfil that wish for every Indian,” said founder Utkrishta Kumar, who named his brainchild on the Sanskrit word for meteor.

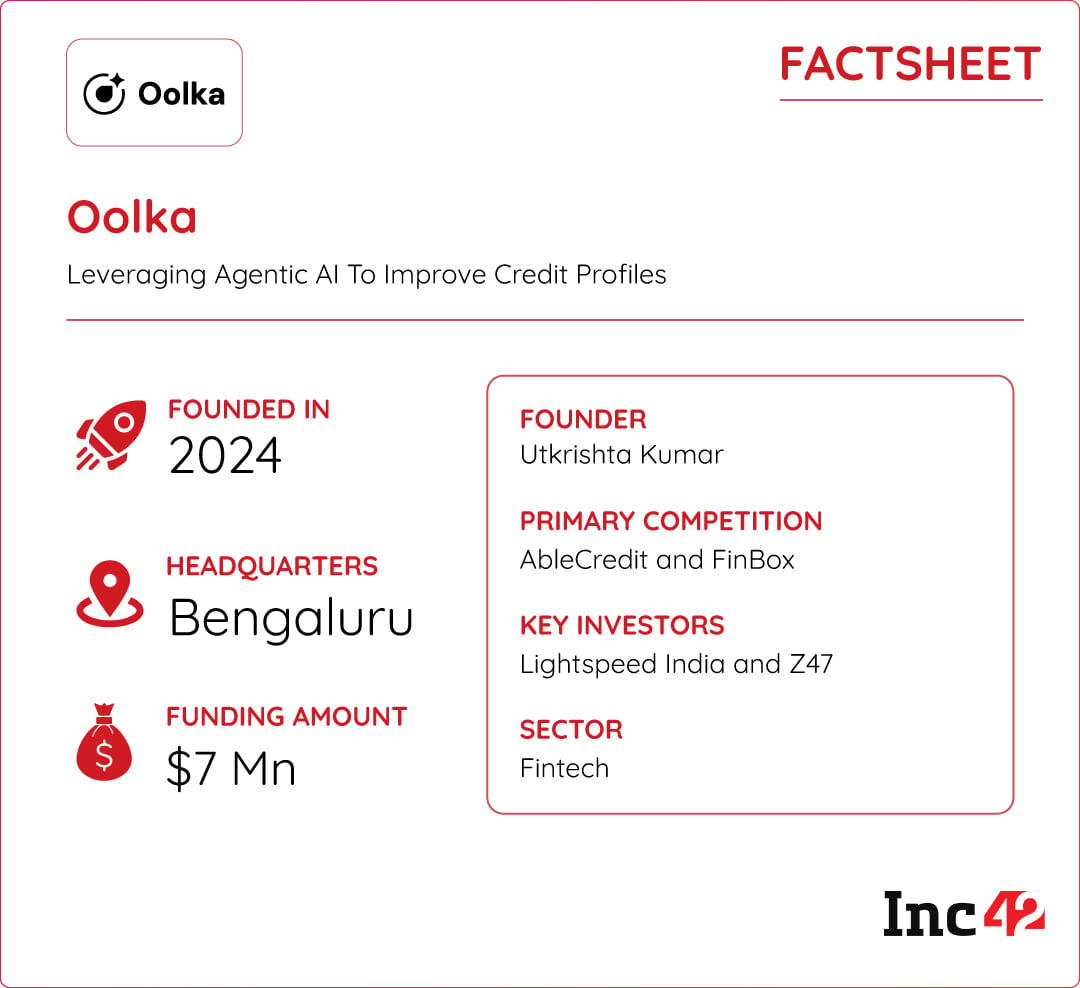

The former Meesho CXO claims that his year-old Oolka is India’s first Agentic AI startup and ready to disrupt the credit management segment. While also being a credit marketplace offering financial products, including credit cards and loans, Oolka claims to be leveraging its AI agents to help users track their credit scores and suggest personlised solutions.

The agents can also take remedial measures on behalf of the consumer, when the permission is granted.

“It goes beyond advising. It goes beyond just generalised guidance. It takes actions that help users improve their not just credit score, but the overall credit health,” Kumar said.

The startup competes with the likes of AbleCredit and FinBox. While giants like CRED also offer AI-led insights on a customer’s credit score, Oolka claims to have the first-mover’s advantage of deploying AI agents acting on behalf of the customer.

“Oolka’s approach is agentic, not conversational. Dhruva, our proprietary AI agent, doesn’t just answer questions, it takes end-to-end actions. It has a strong engagement moat where users have multiple agentic interactions every month, creating a data-rich loop that compounds accuracy and trust.”

The startup, which has so far raised $7 Mn in its seed funding round, is backed by investors like Lightspeed India and Z47 (formerly Matrix Partners India).

The AI Edge In Credit Management“Millions of Indians were able to buy online but still struggled with credit awareness, loan repayments, and improving their credit health,” Kumar said.

“While ecommerce made options accessible to us, the next step was to democratise credit.”

The realisation that financial freedom, rather than just access to products, drives aspirations, became the foundation for Oolka, the founder added.

The IIT Kharagpur graduate, who went on to serve Meesho as the chief business officer, designed the AI agents to study credit reports, flag issues, suggest measures, and play on behalf of the user in the entire credit management journey.

All it takes is a permission from the user. And, the AI agent is ready for a role play in dealing with lenders. But how does it happen?

Oolka drafts a response on behalf of the customer and sends it across to various lenders. Kumar shared a case study, where a user from Meghalaya was making a hefty repayment on her home loan. Oolka’s Agentic AI raised a flag to the user, saying that the loan was on the higher side and wasn’t competitive.

“The agent then began a negotiation on behalf of the user with the lender, of course, with the user’s consent, and helped bring down the rate as the repo rate was revised.”

In another instance, Oolka spotted some issues in a report with some fields incorrectly updated and showing a loan unpaid even though it was paid off. “Our ability to not just spot it and flag it to the user, but also to directly engage with the bureau through Agentic AI, log a ticket and, on behalf of the user, help rectify the errors,” Kumar said.

Agentic AI does not just understand and comprehend user-specific credit reports, but also suggest what to change and then act once the user is willing to make the change and be more creditworthy by improving the credit score.

To access Oolka’s Agentic AI services, the user doesn’t need to borrow from the platform. For an ongoing loan, the user can login to Oolka and give access to his credit report. Once the permission is granted, AI scans and flags any point where the user can save money. For instance, a user has a home loan and he gives access to Oolka. In case the loan has a higher interest rate than market standards, the AI agent flags it and initiates a negotiation process on behalf of the user with the lender.

“In such a case, Oolka’s AI agent will negotiate and ensure that since the repo rate has been revised and whatever is the competitive interest rate in the market pushes the lender for a reduction in interest,” Kumar explained.

The platform also ensures timely payment of EMIs to constantly work on improving the credit score of the user. “Working closely with India’s mass-aspirational users, I noticed that most borrowers didn’t lack the intent to repay – they lacked visibility, structure, and trustworthy guidance,” Kumar said.

Oolka is designed to support nearly 100 regional languages as it looks to tap India’s next billion-strong consumer market.

Things often go wrong when people tinker with vital information. Fresh vulnerabilities can emerge that can be exploited and existing tax or loan payments may disappear. One wrong move may distort the entire creditworthiness.

Oolka deals with a host of the individual information in the form of data. Data privacy is naturally of prime concern to the company.

Manas Gond, who founded AI-led tax management platform Prosperr.io, told Inc42 that data transfer has two stages – initially without sharing personal identifiers like names or phone numbers to banks and then, if the user permits and there is a valid offer on the table, hard data is shared.

Oolka claims that all the PII information such as PAN card numbers, phone numbers, and email IDs of users are anonymised before being processed. This means the identity-related data is transformed in a way that the actual personal details cannot be linked back to any individual.

Oolka’s LLMs analyse anonymised or abstract constructs – essentially patterns or data frameworks – without seeing the original identifying details. “We do not send any PII data to LLMs for context building,” Kumar claimed.

While Oolka says it has the first-mover’s advantage as an Agentic AI credit management platform, several players are leveraging advanced AI models and on their way to introduce AI agents as part of their credit management solution suite.

Towards An AI-Powered FutureOolka has partnered with more than a dozen banks and NBFCs, including IDFC and AU Bank and Yes Bank, to offer the financial products on its platform. The company sells credit cards, fixed deposits and loans. Kumar believes that as Oolka’s agents gain users’ trust, its ability to cross-sell instruments is pretty high.

“In the long run, we see us making a lot of revenue from being a distribution centre for cross-selling different financial products. So, from disbursing loans and credit cards, which we are already doing, we want to expand into distributing all possible financial products,” he shared.

The startup reported an annual recurring revenue (ARR) of close to $1 Mn in FY25, with its loans and card repayment amount surpassing INR 100 Cr.

Oolka finds itself racing with an increasing number of fintechs on a simmering turf. Indian fintech startups have jumped on the Agentic AI bandwagon to use AI in merchant retention and survival in online marketplaces.

The rise of tech startups across sectors has fostered an ecosystem where human labour meets digital labour. AI has played the perfect booster for some of the emerging sectors like fintech, healthtech and so on.

And it’s not just fintech companies that have deployed AI tools to innovate their business solutions and offerings, the government too has stepped up efforts to integrate AI into various services. The National Payments Corporation of India (NPCI) has just declared an Agentic AI pilot framework for UPI, marking the next phase of what it calls “intelligent commerce”.

“We have a simple objective – helping individuals make their financial wishes come true by the use of advanced technology,” Kumar said.

As AI rapidly becomes central to the fintech sector, transforming how businesses gather, analyse and act on information, the year-old fintech startup plans to roll out a live voice agent in the next two months, onboarding more banks and NBFCs and introducing other AI agents to facilitate better financial management to its users.

[Edited By Kumar Chatterjee]

The post How Oolka’s Agentic AI Drives Up Credit Scores appeared first on Inc42 Media.

You may also like

Combating hate: Hindu and Jewish leaders unite for seven-city US tour against rising hate

'Best selling' outdoor furniture cover sees price drop by almost a third

'You are a pig Trump': Hackers breach several airports in US, Canada; pro-Hamas messages flashed

Gujarat: CM Bhupendra Patel meets Governor to seek permission for swearing-in ceremony of new cabinet

AI-driven solutions at GITEX focused on trust and efficiency