The sizzler is back on the table – steamy hot and tantalising – much like India’s $55 Bn food delivery market that’s just rolled into the second course of a raging discount war.

From a clash of two titans – Swiggy and Zomato – that together control 90% of the space, the war has evolved into a tripartite conflict. This time, it’s a face-off between the aggregators and state-backed ONDC, which is up for a big bite of the market pie, with restaurants revving up on Rapido to lead the charge.

It was not a sudden flareup, though. The conflict between the Big Two has been simmering for some time with their margins shrinking, and an era of slowed growth kicking off following a sharp decline in user base last year that made deliveries costlier by the day.

Both Swiggy and Zomato attempted everything – from raising commissions and hiking platform fees to bringing in surge fees and increasing delivery fees – in the last couple of years to bump up their margins.

The heat of hikes not only scorched consumer’s money, it also charred the coffers of partner restaurants, who had been clamouring for viable alternatives to end the Swiggy-Zomato duopoly since the last five years.

The entry of ONDC into the ring late in 2022 was a breather, but it fizzled out with the network tapering off the discounts. Food delivery orders on the platform plateaued soon. Industry sources shared with Inc42 that the government has now thrashed out a revival strategy with ONDC, restaurants and top consumer-facing apps to revive the demand and ease the cost load on restaurants.

“We had written to the commerce and MSME ministries, stating that restaurants in the food delivery space needed a bit of support in the form of reasonable incentives,” Anirudha Kotgire and Mandar Lande, the cofounders of Waayu app which has joined ONDC as a restaurant aggregator (seller app), wrote to us.

Sops To Spice Up Food DeliveryCommerce minister Piyush Goyal met various stakeholders in the food delivery space, including ONDC, Paytm’s Vijay Shekhar Sharma, the Ola leadership and some restaurant partners to work around a strategy for reviving the demand without depending on aggregators.

Media reports earlier said that ONDC may offer incentive-based programmes to the seller and buyer apps to jack up the demand. Industry insiders said ONDC has been tasked to dole out the sops under the MSME ministry’s RAMP programme to restaurants on joining the network.

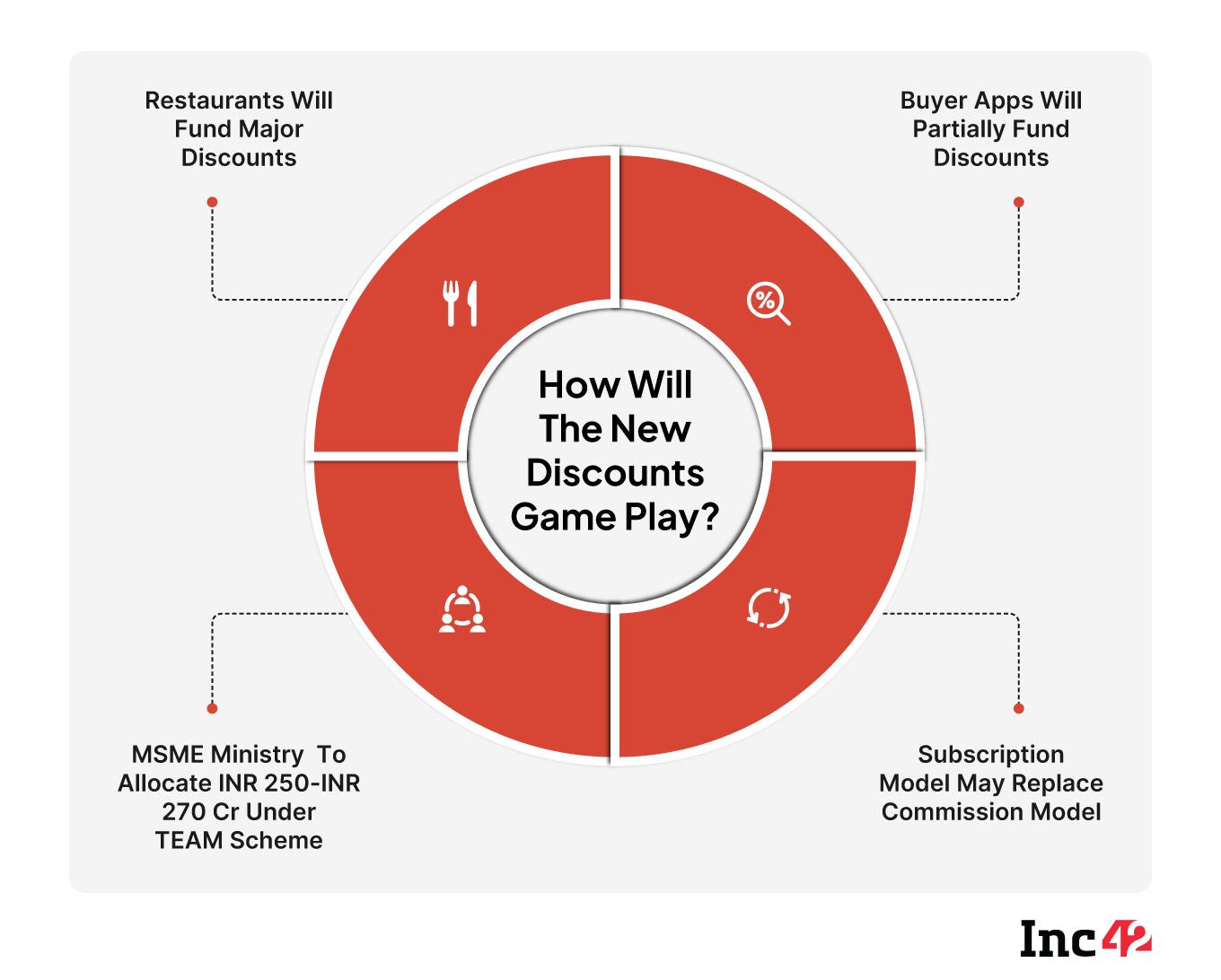

“The government has earmarked INR 200-250 Cr for this incentive programme, but restaurants are also being urged to fund discounts as the network participants (buyer apps) will charge nothing or low commissions from the eateries, compared to what Swiggy and Zomato charge. That is where a lot of ground work has to be done,” one of the sources said, refusing to be identified since it’s still being worked on.

According to the framework, restaurants and cloud kitchens will bear the upfront cost of food packaging and taxes in the beginning, may or may not charge delivery fees, and pass on only the menu prices to the consumer. The government has also reached out to large consumer apps like Ola and Paytm, seeking to allocate a portion of their budgets to food delivery services.

“We could see this being implemented in another few weeks with food delivery services turning reasonably cheaper than Swiggy and Zomato,” the source said.

“We could see this being implemented in another few weeks with food delivery services turning reasonably cheaper than Swiggy and Zomato,” the source said.

Unlike in the past, when ONDC’s shareholders were keen on funding the discounts, this time the push has come directly from the government because some of the biggest shareholders, including banks and corporates, did not see deep discounting as a sustainable strategy.

As the food delivery dynamics evolves majorly, the National Restaurant Association of India (NRAI) and various F&B sector representatives have sought access to the consumer data, requesting greater transparency in the ecosystem. Food aggregators have so far kept this data pool out of bounds for the restaurants.

At a time when Swiggy and Zomato practically control the entire user funnel across the food delivery chain, the NRAI is revisiting its discounts strategy to score a brownie point as Swiggy and Zomato battle a slowdown in the industry, sources privy to the negotiations, said.

The development comes close on the heels of the NRAI locking horns with Swiggy and Zomato by moving the Competition Commission of India (CCI) after the platforms forayed into instant food delivery space and launched their private-label brands ‘One’.

The restaurant body called this a violation of fair trade rules, accused them of not being transparent with end-consumer data and, promoting affiliate brands or cloud kitchens and charging substantially higher commissions. Both Swiggy and Zomato argued that the private-label food ventures wouldn’t impact their partner restaurants.

Food delivery demand, however, remained subdued for both the aggregators, though the overall consumption in the economy picked up over the past few quarters.

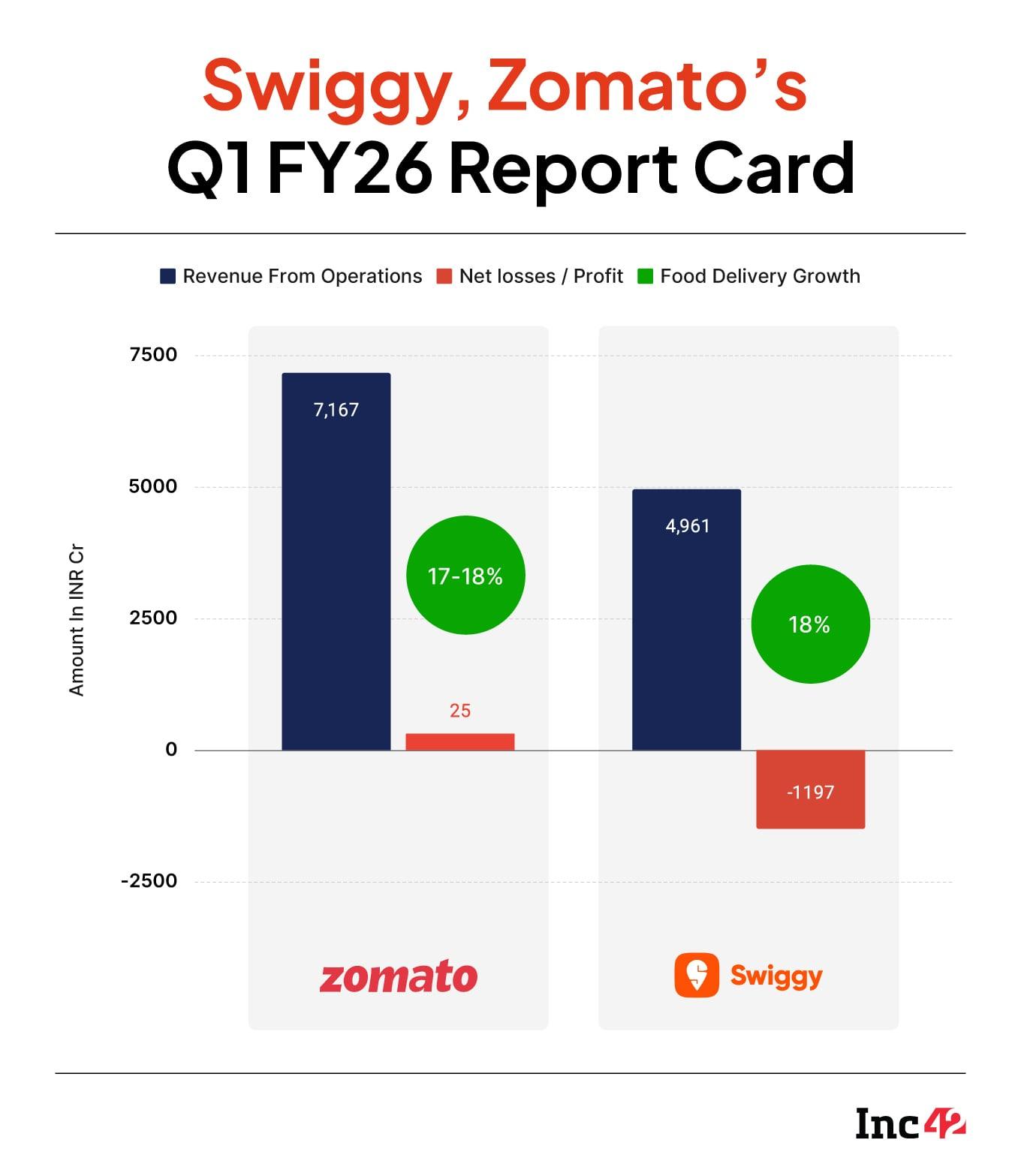

Food Delivery Broth Turned TangyBlinkit overtakes Zomato – last month’s screaming headlines on Eternal’s Q1 earnings perhaps did not surprise most stakeholders in the online food delivery industry. For both Eternal and Swiggy, the core food delivery business turned into the core revenue driver as well as the main margin generator.

“For FY26, it looks unlikely that the business will deliver more than 20% net order value growth but we should be north of 15% and hopefully trending towards 20% YoY growth in FY27,” Eternal CEO Deepinder Goyal said in a statement.

Goyal minced no words in acknowledging the heat from restaurant-funded discounts. “We saw a QoQ increase in restaurant-funded discounts (as a percentage of GOV) in Q1FY26, which led to the slightly lower NOV growth vis-à-vis GOV growth during the quarter (NOV is GOV minus discounts). We expect such quarterly fluctuations to be a regular feature as restaurants calibrate their investments in discounts based on changes in the demand environment.”

Zomato’s food delivery revenues grew 10% year-on-year in Q1 of FY26 to INR 2,657 Cr, while its NOV grew 9% on-quarter and 13% on-year.

Goyal, however, asserted that there was no immediate threat to Zomato’s food delivery business because of the entry of new players. “New ideas, new entrants and disruption are all inevitable. I think it also makes our business stronger as long as we are able to learn, adapt and out-innovate potential competition. At this point, we do not see any innovation in the space which makes us believe that this business is under any obvious threat.”

Goyal, however, asserted that there was no immediate threat to Zomato’s food delivery business because of the entry of new players. “New ideas, new entrants and disruption are all inevitable. I think it also makes our business stronger as long as we are able to learn, adapt and out-innovate potential competition. At this point, we do not see any innovation in the space which makes us believe that this business is under any obvious threat.”

There are some contrarian voices, too, questioning the government’s bid to bring back the food delivery cart on track. Sameer Sharma, the CEO and founder of uEngage, a seller app working as a restaurant onboarding platform and digitising restaurants, doesn’t see more discounts from restaurants as a viable option.

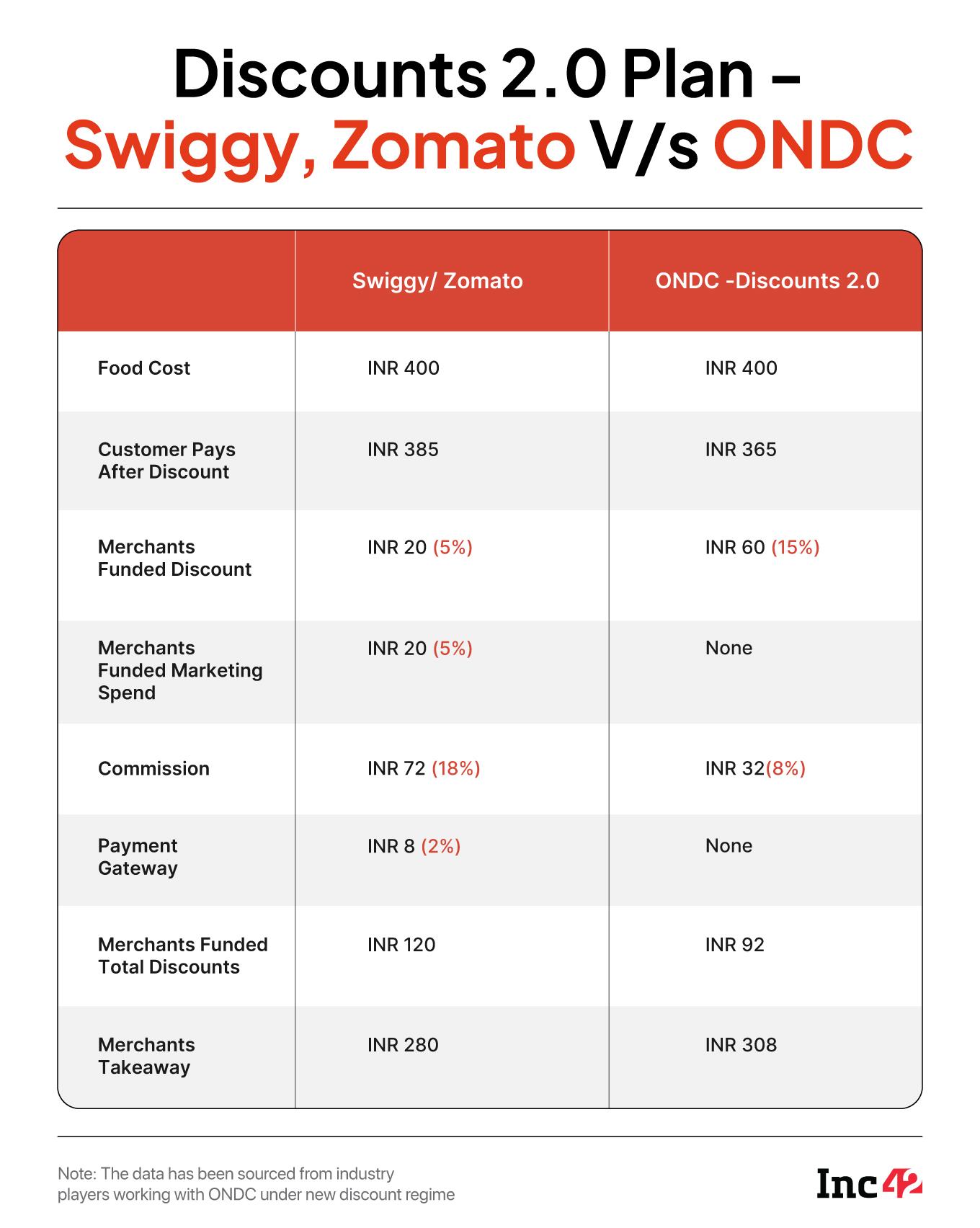

Restaurants grappling with operating costs and inflation, have started complaining that the 20–30% commission burden on these platforms has become unsustainable.

“We have in fact sensitised restaurants on how they end up paying over 15% commissions, which is usually underlined in contracts or agreements. There are various additional components like logistics costs, payment gateway charges, pay-on-click charges and advertisements through which restaurants end up burning 35-40% of each transactional value,” Sharma said.

Can ONDC 2.0 Sweeten The Deal?The Open Network of Digital Commerce (ONDC), partially backed by the government, made a splash in the food delivery sector, raining discounts in 2023-24. It generated heavy demand by roping in consumer-facing apps like Ola, Magicpin, Paytm and Tata Neu and asked them not to charge hefty commissions from restaurants or keep a zero-commission model.

Demand generation and access to a wide set of consumers have always been critical to ONDC’s success, which translates to its core dependence on large consumer apps. Although there are many new entrants, especially large brands like Bajaj Finserv and Tata, in the food delivery space, apps like Ola and Paytm always had an edge.

“In 2024 and 2025, both Ola and Paytm began focussing more on their core businesses and hence there were no further investments in food deliveries which also slowed down ONDC,” Sharma of uEngage said.

The government has brought back ONDC in its second avatar, dusting off the same discount play. The game now hinges on how restaurants react to the restructured blueprint.

Waayu, which has recently joined as a restaurant aggregator on the sellers’ side and gears up to roll out a consumer-facing buyer app on ONDC, plans to make money from subscriptions. The company plans to charge zero commission to the restaurants so that they could focus on discounts. Instead, they will charge the restaurants a subscription fee, irrespective of their transactions, according to cofounders Anirudha Kotgire and Mandar Lande.

The ONDC leadership plans to maintain a sustainable model that will be fully transparent with the restaurants on discounting. “However, the early pilots in the newer push for food delivery suggests that the consumer will get the food at almost the same price as mentioned on the restaurant menu, which is unlike the case with Zomato or Swiggy,” an industry insider said, choosing not to be identified.

Rapido In The Ring For A Piece Of CakeRapido, which emerged as a disruptive force in the shared mobility sector, unseating Ola and Uber and forcing them to move to the zero-commission model, has entered the food delivery space with Ownly.

The consumer app, according to its initial announcements, will focus on low-cost meals under a zero-commission model for India’s price-sensitive market. “We believe that growth in this market will be driven by structural change – either in the cost structures that govern this activity or in the offerings that drive demand,” Rapido explained in a note on Ownly, a food delivery app, sent to NRAI members.

Rapido, according to sector analysts Inc42 spoke to, is being seen as a great demand generation channel like Paytm and Ola and restaurants may find it as a viable alternative as they work out discounts with the ride-hailing apps.

One of the hooks for Rapido and, in fact, its biggest advantage is in-house logistics, according to a senior analyst. “ONDC had earlier proven to be a pain-point for restaurant partners since there were multiple operators, including seller and buyer apps and a third-party logistics service provider, for every transaction made on the network. Rapido scores well on this point and seems to have earmarked a sizeable budget for its food delivery,” said the analyst, requesting anonymity.

Can Brothers Bring Home The Bacon?One of the central philosophies that seems to have united ONDC, Rapido and restaurants is passing on the pricing factor to F&B partners and building relationships with the end-consumer.

For nearly a decade, restaurants were seen as listing on aggregator platforms that had no visibility of consumer data, little control over pricing, and margin dilution. If the subscription and zero-commission model as advocated by the restaurant body and even the government takes off, insiders believe, there will be a revival of demand in the food delivery industry.

Sharma of uEngage said that ending the dominance of Swiggy-Zomato duo, which has built relationships with restaurants, have data of millions of consumers, would not be a near-term possibility. In the long run, the whiffs of an end to the Swiggy-Zomato Raj may turn stronger as the aggregators refuse to burn more cash and, instead, focus on unit economics.

At the same time, the new entrants to the food delivery space are recasting their strategies away from the commission-led model and putting their bets on subscriptions.

As the industry hits an inflection point, ONDC’s rise, restaurant-led discounting, and Rapido’s zero-commission model together form the earliest trend of a change in the ecosystem. For consumers, this could mean better pricing, wider options, and more transparency. For restaurants, it could finally be the beginning of a delivery model that scales without bleeding.

But, as with every market reset, execution will decide who actually wins.

Edited By Kumar Chatterjee

The post ONDC, Restaurants Ride Rapido In Food Delivery Race With Swiggy, Zomato appeared first on Inc42 Media.

You may also like

Rajasthan: 3 workers killed, 5 injured as wall collapses in construction site

'Drishyam' Made in ₹5 Crore, Earned Over ₹60 Crore, Ran for 150 Days, Remade in 6 Languages Including Hindi

Bangladesh: 121 people killed, 5189 injured in 471 incidents of political violence since Yunus took over

Mikel Merino thinks Liverpool could be signing an incredible player as 'agreement reached'

Tollywood Halted: Workers Strike from August 4, Demand 30% Pay Hike, Film Shoots Across Industry Stopped